Have you ever looked at your water bill or property tax and wondered why a stormwater utility fee item is included? This article will explore the history of stormwater utility fee collection, how they are administered, and their vital role in protecting our valuable water resources.

Figure 1. Runoff-generating impervious surfaces associated with residential development (e.g., rooftops, driveways). Image credit: iStock.com.

Revenues from stormwater utility fees are utilized by cities with municipal storm sewer systems (MS4s) to manage their stormwater discharges into federal and state waters. When we build roads and buildings, we often cover the ground with hard surfaces. This stops rainwater from seeping into the ground, which could lead to more flooding and could affect water quality (figure 1). The primary and most pressing threat to water quality in the United States stems from urban stormwater runoff.1 When it rains, runoff flows over surfaces such as rooftops, driveways, and parking lots, picking up pollutants along the way. This water enters the municipal storm sewer system (MS4) without treatment and eventually makes its way to waters of the United States, including rivers, lakes, and beaches. The responsibility for managing this additional water volume usually falls to local stormwater programs. To generate a steady flow of funding for stormwater programs that aim to prevent flooding and water pollution, many MS4 communities collect stormwater utility fees from residents.

What is a Stormwater Utility Fee?

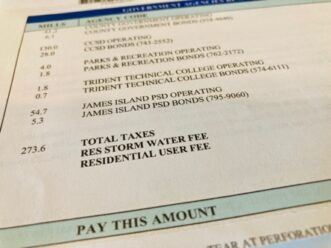

Figure 2. Example of a stormwater fee included on a property tax bill for Charleston County. Image credit: Amy Scaroni, Clemson University.

Stormwater utility fees, sometimes called stormwater fees or stormwater drainage fees, are collected from residents and commercial establishments, usually through a property tax or water bill (figure 2). While it is included as a line item in the annual property tax bill in some municipalities, it is important to note that stormwater utility fees are commonly classified as user fees (amount paid for a specific service) rather than a tax (imposed to raise revenue to fund general government services). Even tax-exempt organizations could be required to pay stormwater fees in some municipalities.2 The primary purpose of collecting stormwater utility fees is to generate an alternative or additional source of revenue dedicated explicitly to stormwater management programs.

Stormwater utility fees were established in response to the Water Quality Act (WQA) of 1987, an amended version of the Clean Water Act (CWA) of 1972. This act regulates the discharge of pollutants into U.S. waters to maintain water quality standards. Depending on their population size, many municipalities and cities were required to obtain National Pollutant Discharge Elimination System (NPDES) permits. This permit outlines the minimum control measure that MS4 communities must implement to manage stormwater. It also highlights the need to develop and implement a stormwater management program (SWMP). Although the regulations enhanced the role of states and cities in managing stormwater, they did not effectively secure a reliable funding source.

Historically, stormwater management was funded through the general fund budget or as part of broader infrastructure projects.3,4 However, allocating adequate resources for stormwater management became challenging due to competing priorities and limited funds. To address the funding gap and establish a dedicated revenue source for stormwater management, municipalities began introducing stormwater utility fees. Unlike the general fund budget with restricted use, stormwater utility fee revenues may cover direct costs such as construction, maintenance, and operations.3 This concept gained traction in the 1970s and 1980s in the United States, but stormwater utility fees were not widely adopted until the 1990s.2 In 2022, there were 2,057 stormwater utilities across the United States, which is 200% more than the number of stormwater utilities in 2007 (n=635 utilities).2,5 In South Carolina alone, an estimated 44 stormwater utilities are in place, serving 2.7 million residents.5

What Are the Different Ways to Administer Stormwater Utility Fees?

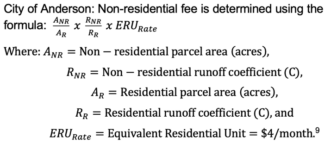

Stormwater utility fee collection is supported by local ordinances; hence, the fee rates and collection mechanisms vary across South Carolina. To equitably distribute the cost of managing stormwater, stormwater utility fees are typically computed based on the amount of impervious or hard surfaces on a property. Aside from impervious area, the fees are sometimes calculated based on other factors such as property size or other relevant metrics that reflect the potential impact of each property on stormwater runoff. Although this approach is considered more equitable because it ensures a fair distribution of stormwater costs among property owners, MS4 communities often opt for a flat or tiered fee structure, which offers greater ease in administration and monitoring (table 1).

Table 1. Some examples of how stormwater utility fees are administered in South Carolina.6-10

In other parts of the United States, stormwater utility fees are sometimes computed based on total water usage (water meter readings). For instance, the Village of Northbrook, Illinois, charges $1 per 1000 gallons of water consumed.11 In Sante Fe, New Mexico, the commercial stormwater fee is computed relative to the meter size.12

Aside from stormwater utility fees collected by the county or city, some homeowners’ associations (HOA) also collect a separate fee for maintaining their subdivision’s stormwater control measures (e.g., stormwater ponds). This fee varies depending on the rules of the respective HOA.

How Are Stormwater Utility Fee Revenues Allocated?

The revenues generated from collecting stormwater utility fees are vital in financing various stormwater programs. Some jurisdictions are entirely dependent on their stormwater utility fee revenues to fund their program needs, while others must also rely on additional funding sources (e.g., bonds, grants, sales tax, and loans). In a survey conducted by the Southeast Stormwater Association (SESWA) in 2019, 48% of the 136 responding jurisdictions utilized stormwater utility fee revenues and non-fee funds for capital construction programs.13 For the stormwater operating budget, 78% of jurisdictions entirely rely on stormwater utility fee revenues only.13

Depending on the jurisdiction, stormwater utility fee revenues are commonly used to fund the following activities:

Operations and Maintenance

Typically, the most considerable portion of stormwater funds are allocated towards the ongoing operations and maintenance (O&M) of stormwater management infrastructure. This involves activities like regular inspections, cleaning, repair, and maintenance of storm drains, detention basins, and other stormwater facilities. The 2019 report of SESWA indicated that most of the stormwater personnel are assigned to perform O&M activities.13

Capital Improvements

Aside from upgrading stormwater infrastructures, the construction of new stormwater infrastructure is necessary to keep up with the increasing urban runoff caused by continued development and extreme climate events. Due to the high cost of capital improvement projects, stormwater utility fee revenues are often complemented with other fund sources. Other examples of capital improvement projects include the implementation of green infrastructure initiatives or retrofitting existing infrastructure to improve water quality and reduce flood risks.

Water Quality Monitoring

To ensure that water quality standards are met, MS4 communities conduct regular water quality monitoring. According to the SESWA survey (2019), 80% of the 136 responding jurisdictions reported that they monitor improvements in water quality.13 This activity involves collecting and analyzing samples from stormwater runoff, streams, and other water bodies to assess their quality, identify potential pollutants, and monitor the effectiveness of stormwater management measures. Information derived from water quality monitoring programs is crucial to guide decision-making and evaluate the overall success of stormwater management programs.

Administrative Operations

A portion of stormwater utility fee revenues is used to support the administrative functions of stormwater programs (e.g., permit administration, compliance monitoring, and program coordination). On average, approximately 13% of stormwater funds were allocated for administrative operations in the Southeast in 2019.13

Public Education and Information

Aside from infrastructure maintenance and operation, stormwater programs also include education and outreach to raise public awareness of stormwater pollution, stormwater best management practices (BMPs), and the importance of water resources. Stormwater utility fee revenues may be allocated towards workshops, educational materials, public awareness campaigns, and partnerships with local organizations or schools.

The specific allocations of stormwater utility fee revenues may vary depending on the priorities of jurisdictions, as each region tailors its funding usage to address local stormwater management needs and regulatory requirements.

Are Stormwater Utility Credits Available?

Some municipalities offer stormwater utility credits or discounts to encourage the adoption of BMPs (e.g., stormwater ponds, rain gardens, bioretention swales, and permeable pavements). For instance, Berkeley County gives stormwater utility credits to qualified non-residential properties with BMPs such as bioretention cells, vegetated swales, and other practices that manage stormwater at its source.14 The City of Greenville also offers up to 70% discount on stormwater utility fees to eligible commercial, industrial, institutional, or multi-family residential properties.15

To determine if your county provides a reduction in stormwater utility fees, visit your county’s stormwater website or contact your local stormwater manager.

Conclusion

Stormwater utility fees play a vital role in protecting water resources by providing the necessary funding to manage stormwater runoff and mitigate pollution effectively. With rapid urbanization and continued population growth, managing stormwater across South Carolina is an increasingly complex challenge. With over 1,200 impaired waterbodies in the state in 2022, it is imperative to both reduce the total volume of runoff generated and improve the quality of runoff to restore and protect our water resources.16,17 Having a dedicated fund source for stormwater ensures the sustainability of stormwater management programs and secures ongoing protection of our valuable water resources.

References Cited

- Jefferson AJ, Bhaskar AS, Hopkins KG, Fanelli R, Avellaneda PM, McMillan SK. Stormwater management network effectiveness and implications for urban watershed function: a critical review. Hydrological Processes. Sep 2017;31(23):4056–4080. doi:10.1002/hyp.11347.

- Zhao JZ, Fonseca C, Zeerak R. Stormwater utility fees and credits: a funding strategy for sustainability. Sustainability. Feb 2019;11(7):1913. doi:10.3390/su11071913.

- Allen LJ. Factors influencing the establishment of stormwater utilities in the United States. Journal of Urban and Environmental Engineering. May 2020;14(1):3–31. doi:10.4090/juee.2020.v14n1.003031.

- DeForest KL. The impact of dedicated North Carolina stormwater programs and revenue on water quality in communities: a literature review and case study approach [master’s thesis]. Chapel Hill (NC): University of North Carolina Chapel Hill; 2020. https://cdr.lib.unc.edu/concern/masters_papers/1z40m026m.

- Campbell W. Western Kentucky University stormwater utility survey 2022. Bowling Green (KY): Western Kentucky University; 2022. SEAS Faculty Publications. Paper 6. p. 1–101. https://digitalcommons.wku.edu/seas_faculty_pubs/6/.

- Dorchester County. Stormwater Utility Fees. Summerville (SC): Dorchester County, Public Works, Engineering; 2023. https://www.dorchestercountysc.gov/government/public-works/engineering/stormwater-fees.

- Aiken County. FAQ: How are Stormwater Fees Determined? Aiken (SC): Aiken County Government; 2023. https://www.aikencountysc.gov/DspFAQ?qFAQID=77.

- North Myrtle Beach, SC, Ordinance for Storm Water Drainage Fees, Chapter 13, Article IV, Section 13–116 through 13–118. 2017. https://www.nmb.us/DocumentCenter/View/166/Storm-Water-Utility-Fees-PDF.

- City of Anderson. City of Anderson Stormwater Billing Policies and Procedure. Anderson (SC): City of Anderson; 2007. http://www.cityofandersonsc.com/wp-content/uploads/2016/10/stormwater-billing-policies-and-procedures.pdf.

- Beaufort County. Stormwater Fees. Beaufort (SC): Beaufort County, Stormwater Management; 2023 https://www.beaufortcountysc.gov/stormwater/stormwater-fees.html.

- Village of Northbrook. Northbrook Stormwater Utility. Northbrook (IL): Village of Northbrook, Stormwater Management; 2023. https://www.northbrook.il.us/299/Northbrook-Stormwater-Utility.

- City of Santa Fe. Stormwater Utility Charges – Frequently Asked Questions. Santa Fe (NM): City of Santa Fe, Public Works; 2023. https://santafenm.gov/public-works/parks-and-open-space/river-and-watershed/stormwater-utility-charges-frequently-asked-questions.

- Southeast Stormwater Association. 2019 Southeast stormwater utility report. Tallahassee (FL): Southeast Stormwater Association; 2019. 56 p. https://www.seswa.org/assets/Services/Utility-Surveys/2019-Survey/Report%20for%20Website.pdf.

- Berkeley County Government. How Is the Stormwater Utility Fee Credit Applied? Moncks Corner (SC): Berkeley County; 2023. https://berkeleycountysc.gov/faqs/how-is-the-stormwater-utility-fee-credit-applied/.

- City of Greenville. Credit Policy. Greenville (SC): City of Greenville; 2023. https://www.greenvillesc.gov/463/Credit-Policy.

- Scaroni AE, Duda MD, Criscione A, Jones M. Gauging residential knowledge and behavior to inform stormwater outreach efforts across South Carolina. Journal of South Carolina Water Resources. 2021;8(2):29 –38.

- S.C. Department of Health and Environmental Control. The State of South Carolina’s 2020 and 2022 integrated report (IR)- Part 1: Section 303(d) listing of impaired waters. Columbia (SC): South Carolina Department of Health and Environmental Control; 2022. https://scdhec.gov/sites/default/files/media/document/South%20Carolina%202020-2022%20303%28d%29%20List_1.pdf.