In recent decades, market-based instruments to reduce emissions of greenhouse gases (GHG) have received considerable attention at international, national, and regional levels. Notable among them is the cap-and-trade policy. Cap-and-trade is a cost-effective approach designed to limit, or cap, the total level of GHG emissions from industries. The most popular cap-and-trade programs to reduce GHG emissions include the European Union’s Emissions Trading System, the Northeast Regional Greenhouse Gas Initiative, the Midwestern Regional Greenhouse Gas Reduction Accord, and California’s Cap-and-Trade Program (CA-CTP), which is part of the Western Climate Initiative (WCI).1 The WCI is a non-profit corporation that administers the emissions trading market between California and the Quebec province in Canada. The CA-CTP is the second-largest carbon market in the world, established by the California Air Resources Board (CARB) under Assembly Bill 32 (also known as California Global Warming Solutions Act of 2006). One of the goals of Assembly Bill 32 is to reduce California’s GHG emissions to 1990 levels by 2020.2 In 2017, Assembly Bill 398 was passed to provide guidelines on the CA-CTP beyond 2020.3 GHG reduction targets of Assembly Bill 398 are a 40% reduction from the 1990 levels by 2030 and achievement of carbon neutrality by the year 2045.3 This brief explores the CA-CTP and its potential of engaging South Carolina family forest owners in the carbon market through creation and trading of “carbon offsets,” also known as “carbon credits” or “carbon offset credits.”

What is a Carbon Offset?

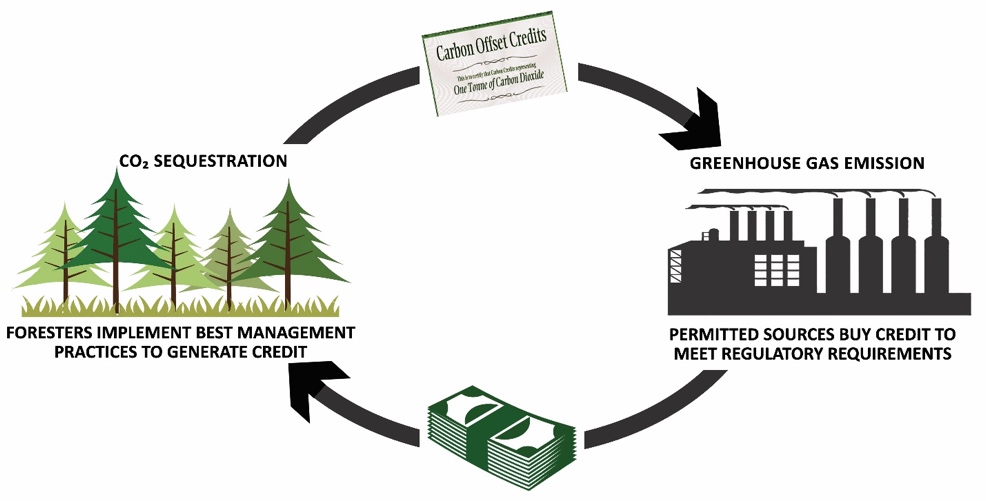

A carbon offset is equivalent to one metric ton of carbon dioxide (CO2),4 and it is a reduction in emissions of CO2 or GHGs (from sectors not covered by a cap) to offset emissions from regulated entities, companies, or organizations that are subject to the laws and rules administered CARB.2 These regulated entities under the CA-CTP can only purchase and use carbon offsets from registered uncapped sectors. Demand for forestry carbon offsets, in particular, is likely to increase in the United States as the carbon market under the CA-CTP grows (see figure 1 for a simple illustration of a framework of forest carbon market). The economic value for emission reductions in sectors that are not covered by the cap is determined by the offsets generated.

Figure 1. Carbon Market Process. Image Credit: Clemson University.

Why is Forest Carbon Sequestration Important?

Forests act as carbon sinks and play an important role in combating climate change and its impacts. Climate change is caused by anthropogenic activities. It is a global challenge in that emissions anywhere affect the global environment, and hence, people everywhere, suggesting the need for international cooperation in combating climate change.5 However, comprehensive GHG emission reduction policies are lacking at nationwide levels in most countries including the United States. To achieve low-carbon economies in the United States, states and organizations advocate policies that reduce GHG emissions. The CA-CTP, for instance, allows the use of carbon offset from projects that are capable of reducing GHG emissions to be sold in California’s carbon market as a means of compensating owners for reducing GHG emissions. A carbon offset can be created by any qualified project in any part of the United States and sold to a regulated company in California to offset its emissions. Projects currently approved as sources of carbon offsets under the CARB’s forest offset protocol are United States forest projects.2 Under the forest offset protocol, credits generated are based on total amount of carbon sequestered by a forest in metric tons of CO2. To qualify for participation in earning offsets, a project must be managed for the purpose of reducing GHG emissions, providing wildlife habitat, and improving watershed benefits for a minimum of one hundred years.6

Carbon sequestration and the sale of carbon offsets by South Carolina family forest owners will be beneficial in many ways, including combating climate change. Southern United States are predicted to be the hardest-hit in terms of economic losses due to climate change.7 Increases in mean sea level have higher direct economic damage on the gross domestic product of South Carolina and other southern states than their counterparts.7 Participation in the carbon market will also help in providing habitat for wildlife and improving watershed benefits for South Carolina. In addition, it would create market opportunities for carbon trading in South Carolina and provide opportunities for supplemental annual income to participants.

How Can South Carolina Family Forest Owners Create Offsets to Sell?

Forest management in South Carolina, including timber harvests, is in compliance with the state’s recommended best management practices (BMPs).8 The BMPs ensure compliance with the Clean Water Act. In addition to forest certification, which serves as a hallmark of good forest stewardship in the state, South Carolina family forest owners can generate carbon credits based on forestland management activities recommended by CARB. CARB’s forest offset protocols provide eligibility rules under which GHG reductions of forest offset projects are calculated, and also for monitoring and reporting of offset projects and offset project data, respectively.9 CARB requires that offsets must be real, additional, permanent (cannot be reversed), verifiable, quantifiable, and enforceable. Based on the forest offset protocols, offset projects must sequester carbon in addition to other ecological functions. CARB’s recommended types of offset projects are reforestation, improved forest management, and avoided conversion of forestland to non-forestland uses.10 Currently, most of the forest carbon offset projects have used improved forest management protocol. The reforestation protocol involves tree planting or removal of impediments to natural reforestation, with no rotational harvesting of reforested trees or existing trees during the first thirty years after commencement of the offset project, unless to prevent or mitigate diseases. Improved forest management comprises management activities such as increasing rotation age, thinning diseased and suppressed trees, increasing and maintaining tree stocks at a high level, and all other natural forest management practices that enhance carbon stocks on forestland. Avoided conversion ensures that the forest cover is maintained through a qualified conservation easement and is eligible on forestland that is privately owned prior to commencement as an offset project.

To participate, family forest owners should satisfy some management requirements including the following

- Land management activities must comply with all federal, state, and local law regulations.

- Forest volume in the project area must be maintained or increased over the project life, except for unintentional decline due to unavoidable catastrophe.

- Project lands must consist of a mix of native tree species.

To bring a forest carbon offset project to the CA-CTP, the project must first get listed with a CARB approved carbon registry such as the American Carbon Registry, Climate Action Reserve, or Verra (formerly Verified Carbon Standard), followed by a complete tree inventory of the project area. Based on an analysis of the inventory data, the amount of available carbon offset is calculated for the project and verified by a third party. CARB then approves the carbon offset project after the verification process which then gives the forest landowner the right to sell the offset credits through a broker.

Some forest projects in South Carolina have already sold carbon offsets in the California carbon market through carbon developers. The Francis Beidler Forest, owned by the Audubon Society, sold approximately 450,000 carbon offsets for more than $8 per offset in California’s carbon market in 2014 through a San Francisco carbon developer company known as Blue Source.11 Brookgreen Gardens also sold 162,551 carbon offsets in California’s carbon market in 2015 through the Green Assets carbon developer company.12

What do Carbon Offsets Mean for South Carolina Family Forest Owners?

South Carolina family forest owners who are willing to participate in the CA-CTP carbon market will receive carbon offset payments annually. Payments received will depend on the carbon offset market price, which is determined by the interaction of supply and demand in the carbon market. Offset prices also vary across type, location, standard, and other attributes of a project.14 The average price of offsets in California’s carbon market has been 10 to 15% less than the average price of auctioned carbon allowances,14 and was about $16 per ton of carbon dioxide equivalent (tCO2e) in February 2020.15

Summary

Forest carbon offsets will provide supplemental income in addition to other benefits for South Carolina family forest owners who decide to participate in California’s carbon market. South Carolina family forest owners will also have the opportunity to contribute to the efforts to reduce climate change impacts if they decide to create and sell forest carbon offsets. Offsets can be sold through credit developers who first find buyers. A buyer can be a broker or the end-user which is the regulated entity in the CA-CTP. The project must get listed with a CARB approved carbon registry for a complete tree inventory to be taken, and the number of offsets to be calculated based on agreed forest management activities. The project is then verified by a third party before CARB’s approval to sell offsets.

Acknowledgments

Special thanks to the South Carolina Natural Resources and Conservation Service (SC NRCS) for supporting this research.

References Cited

- Union of Concerned Scientist (UCS). Existing cap-and-trade programs to cut global warming emissions. 2017. https://www.ucsusa.org/resources/existing-cap-and-trade-programs-cut-global-warming-emissions#.WVJzTFGQyUk.

- Hsia-Kiung K, Reyna E, O’Connor T. California carbon market watch: A comprehensive analysis of the golden state’s cap and trade program. New York (NY): Environmental Defense Fund; c2014.

- International Carbon Action Partnership (ICAP). ETS Detailed Information, USA – California cap-and-trade program [updated April 2020 1]. https://icapcarbonaction.com/en/?option=com_etsmap&task=export&format=pdf&layout=list&systems%5B%5D=45.

- Green Assets. What is a carbon credit? Wilmington (NC): Green Assets; https://www.green-assets.com/.

- Sustainable development goals: Climate action. New York (NY): United Nations; 2019. https://www.un.org/sustainabledevelopment/climate-change/.

- California cap-and-trade program. Sacramento (CA): California Air Resources Board (CARB); https://ww3.arb.ca.gov/cc/capandtrade/capandtrade.htm.

- Hsiang S, Kopp R, Jina A, Rising J, Delgado M, Mohan S, Rasmussen DJ, Muir-Wood R, Wilson P, Oppenheimer M Larsen K. Estimating economic damage from climate change in the United States. Science. 2017; 356(6345):1362–1369.

- Environmental management, South Carolina’s best management practices for forestry. Columbia (SC): South Carolina Forestry Commission; 2017. https://www.state.sc.us/forest/menvir.htm.

- Compliance offset protocol U.S. offset forests projects. Sacramento (CA): California Air Resources Board (CARB); 2011. https://ww3.arb.ca.gov/cc/capandtrade/protocols/usforest/usforestprojects_2011.htm.

- Landowner opportunities. Salem (OR): L&C Carbon; 2017. http://lccarbon.com/landowner-opportunities/.

- Smith B. Audubon Forest in South Carolina sells carbon credits. The Washington Times. 2014 Aug 10. https://www.washingtontimes.com/news/2014/aug/10/audubon-forest-in-sc-sells-carbon-credits/.

- Green Assets (Cision PR Newswire). Green Assets and Brookgreen Gardens earn carbon credits for forest conservation efforts. Wilmington (NC): Green Assets; 2015 Jan 15. https://www.prnewswire.com/news-releases/carbon-offset-project-protects-4000-acres-of-southern-coastal-habitat-300021452.html.

- Hamrick K, Galant M. Unlocking potential: state of the voluntary carbon markets 2017. Washington (DC); Forest Trends’ Ecosystem Marketplace; 2017.

- Kim C, Daniels T. California’s success in the socio-ecological practice of a forest carbon offset credit option to mitigate greenhouse gas emissions. Socio-Ecological Practice Research. 2019 Jun; 1(2):125-38.

- California cap-and trade-program summary of California-Quebec joint auction settlement prices and results [updated 2020 Feb]. Sacramento (CA): California Air Resources Board (CARB). https://ww3.arb.ca.gov/cc/capandtrade/auction/results_summary.pdf.